“The person who doesn’t know where his next dollar is coming from usually doesn’t know where his last dollar went.”

As an Indonesian SME, you work hard to make your business successful.

Your international vendors, suppliers, contractors, staff and freelancers are an important part of your organisation’s ecosystem, and you make every effort to pay them in full and on time. This is very admirable.

But the question is – how are you paying them? If you answered, “through international bank transfers”, stop wasting your money!

International bank transfers are probably one of the most expensive ways to make payments outside Indonesia!

Now that was the bad news. The good news is that there is another cheaper way to make overseas money transfers. Read on to know more.

This article focuses mainly on international transfers (payments) for businesses. However, the underlying message is applicable to individuals as well.

The costs of international bank transfers from Indonesia

Globalisation has made the world a smaller place. This is as true in Indonesia as it is anywhere else in the world. Thanks to globalisation and Indonesia’s increasingly strong presence in international trade blocs like ASEAN, the country’s international trade ties have expanded exponentially over the past few decades. In 2018 for example, Indonesia ranked #28 worldwide in total imports, importing US$180 billion worth of goods from its eastern neighbours like China, Japan and Singapore, as well as other countries like the USA, Australia and Germany. In addition, plenty of Indonesian firms – including SMEs – are now doing business with overseas entities such as contractors, vendors and suppliers. This means that the need for international financial transactions – and methods to make these transactions – has also increased.

On a non-business, i.e. individual level, remittances are also very important to Indonesians. This is evidenced by the huge amounts of money that flow into the country every year. In 2019, this figure stood at US$11.7 billion and accounted for 1.1% of the country’s GDP.

Most Indonesian businesses, including SMEs, well as individuals rely on international inter-bank transfers for these transactions. However, these transactions can be very expensive and have a huge impact on firms’ (or individuals’) costs, and thus on their bottomlines. This is because most traditional banks in Indonesia offer weaker currency exchange rates (which differ from bank to bank) and charge a significant markup on these rates when transferring money abroad. This is applicable whether you transfer money out of Indonesia to USA, India, Germany, New Zealand, or any other country. So whenever there’s a currency conversion – and there will be when money moves out of Indonesia – firms end up losing money.

There might also be other high hidden fees as well, which can raise your international money transfer costs even higher. And these transfer fees and currency exchange fees are applicable even if you use a bank with headquarters in your recipient country and a branch in Indonesia. The first example below will make this clearer.

Example 1: Suppose you want to transfer money to a recipient in India. You approach a leading Indian bank with a branch in Indonesia to make a ‘dollar transfer’ to its branch in India. A dollar transfer is routed through the US so there will be deductions by both US and Indian banks. Here are the charges you can expect.

Indian bank in Indonesia: $10

US Bank: $15

Indian bank in India: $10

Total charge: $35

These charges are applicable for every transaction you make through this bank to pay someone in India through a dollar transfer.

Example 2: You approach an international bank with branches all over Indonesia to transfer money to someone outside Indonesia through a telegraphic transfer (TT). Here are their TT charges through Internet banking:

Involving currency exchange: Rp35,000 – Rp50,000

No currency exchange: US$10-US$75

These charges are even higher if you choose to make the transfer physically from a branch.

Further, this bank places a ‘maximum daily limit’ on the amount of money you can actually transfer out of Indonesia. So not only is each transaction highly expensive, you also have to contend with the inconvenience of ‘staggering’ your payments across multiple days if you have multiple international vendors.

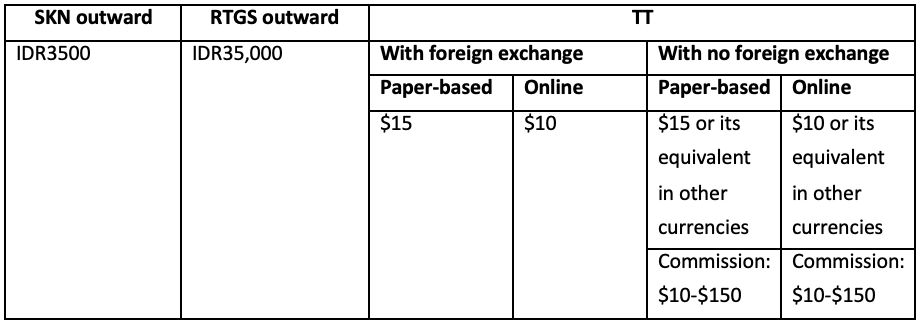

Example 3: Another international bank provides multiple options for outward remittances from Indonesia. These include:

· Telegraphic transfers (TT): transmitted via the SWIFT network

· Sistem Kliring Nasional (SKN): an inter-bank payment and settlement system for low-value payments in IDR

· Real Time Gross Settlement (RTGS): to make high value payments in IDR

More options are great, right? But not if you have to contend with high fees!

For each of these options, the transaction fees for making outward remittances are:

Still think these options are great?

It doesn’t actually cost the banks these amounts to send your money overseas. These banks simply charge arbitrary fees without explaining the Maths behind their calculations. Furthermore, they take advantage of the fact that you, the customer, doesn’t know about or see all the fees involved in the transaction. Some fees are not declared (‘hidden’), so the customer does not pay attention to them and thinks that it’s somehow a normal cost of international money transfers. Some banks do tell you the amount – but only after you've already made your transaction. Result – you end up paying more than you expected or knew about.

And if you’re still thinking that these fees are affordable (or that their exchange rates are reasonable), think again! Banks often ‘pad’ the exchange rate to increase their profits. While a few rupiahs may not sound like a lot to start with, when you multiply these amounts by the $2,000 or ₹2,00,000 you plan on sending overseas, it can all add up to a big cost for you and also make a big difference in the amount ultimately received by your recipient. So the more money you transfer – and the more times you transfer money – out of Indonesia, the more you will pay in fees and charges. These amounts can seriously affect your business’ bottomline over the long term.

Other challenges with international bank transfers from Indonesia

If high costs are not enough of a challenge, consider these other issues you will face when you try to send money abroad from Indonesia through bank transfers:

· Slow transfer speeds: Bank transfers can take 2 - 5 days and sometimes longer. For example, if you make a transfer on a Friday afternoon in Indonesia to a bank in New Zealand – which is 5 hours ahead – the transaction will not be processed until Monday morning. Delays are also common due to bank holidays in the recipient country.

· Minimum or maximum amounts: These limits will vary with each bank. To transfer higher amounts, you may also have to complete more formalities (aka ‘paperwork’) that can further delay your payment commitments.

· Right product or service: For business transfers, you might need a foreign currency account to manage or ‘hedge’ your currency risk. This account can help you lock in the exchange rate when you pay your overseas contractor. Not all banks provide such accounts so you may end up losing money due to exchange rate fluctuations.

· Customer service: Indonesian banks work typical Indonesian business hours. So if you need 24/7 support via phone, email or online chat, this may not be possible.

WALLEX: A cheaper, more convenient way to send money abroad from Indonesia

You want to maintain good relationships with your international vendors and suppliers, and that’s why you want to pay them in full and on time. However, like we’ve already seen, bank transfers are the worst option to transfer money out of Indonesia.

So like we said in the beginning of this article: stop wasting your money!

Make your money go further with international remittance solutions from Wallex!

Wallex offers a comprehensive yet easy-to-use online platform for Indonesian SMEs that combines international payments, transactional FX, collections and more. With Wallex, you also get the best possible exchange rates (mid-market comparable rates) and very low transaction fees compared to banks. Moreover, there are no hidden costs, only 100% transparency – guaranteed.

All you need to do is create a Wallex account to get all these benefits:

· Convert IDR or USD to pay in 38 currencies around the world with a multi-currency wallet

· Connect your wallet seamlessly to global payments, FX and virtual accounts for a full cross-border/global business solution

· Upload multiple payments in one go

· Advanced maker checker matrix for better governance

· 24x7 customer support in Bahasa via phone, email and chat

With Wallex, you can easily manage and convert the currencies you need for your global payments. You can even retain some funds to hedge against volatile FX markets. Wallex works closely with financial regulators in Indonesia including Bank Indonesia and Financial Services Authority Indonesia so you know that your money is completely safe. We also maintain the highest security standards to protect your data and your organisation.

The Wallex advantage:

· Online transfers within minutes (if transaction is completed before cut-off timing) [1]

· Lowest fees and low exchange rates

· Full transparency; no hidden fees or charges

· Designed to meet the unique needs of Indonesian businesses

· Multi-currency support

Get started with Wallex for FREE. Here’s how it works:[2]

Ø Step 1: Register for a free Wallex account here

Ø Step 2: Verify your identify

Ø Step 3: Determine the transfer amount. You will instantly see the applicable fees and exchange rate so you’ll know exactly how much your recipient will receive

Ø Step 4: Enter your recipient’s information such as name, bank account number, etc.

Ø Step 5: Make the payment

Ø Step 6: Check your email for transaction confirmation

Your recipient will receive the money near-instantly. No waiting, no confusion and no nasty surprises!

Wallex offers an easier, cheaper and more convenient way to help you manage your international payments. Maximise the money potential of your business with world-class business remittance solutions from Wallex. For more information, visit https://www.wallex.asia/sg/ or ask our FX expert.

[1] Please refer to SLA for timings for specific currencies

[2] Please check these steps and let me know if corrections are required. Reference

HOW TO :

- add tags to an article

- Manage tags