If you’ve sent or collected any payments internationally, it’s likely that the transaction was facilitated by the SWIFT payment system. This vast network (SWIFT Network), which consists of 11,000 members, has lowered the barriers to international payments and collections. But, with an average of approximately 44 million transactions per day between users and intermediary financial institutions, it becomes tricky to track each transaction and ensure its validity.

And in the absence of a standardised document, the process of dispute resolution due to errors or missing information becomes inefficient at the very least, and costly in severe cases.

Enter the SWIFT MT103 document.

This document is a payment tracking system that allows all of its users access to track their funds, along with the details of the transaction. This not just gives clarity to all parties — the financial institution, the sender, and the beneficiary — it also helps reduce fraudulent transactions through a standardised system.

In this guide, we’ll break down what the MT103 document is, why it is so important, and how you can access it through the Wallex platform.

What is the SWIFT MT103 document?

The MT103 is a document that is generated at the completion of an international wire transfer process. This is a SWIFT message used in telegraphic transfers (TT) from one bank to another (usually a foreign bank).

Also referred to as “Single Customer Credit Transfer”, this transfer instruction contains all the information regarding the cross-border transaction, which typically doubles up as proof or confirmation of payment.

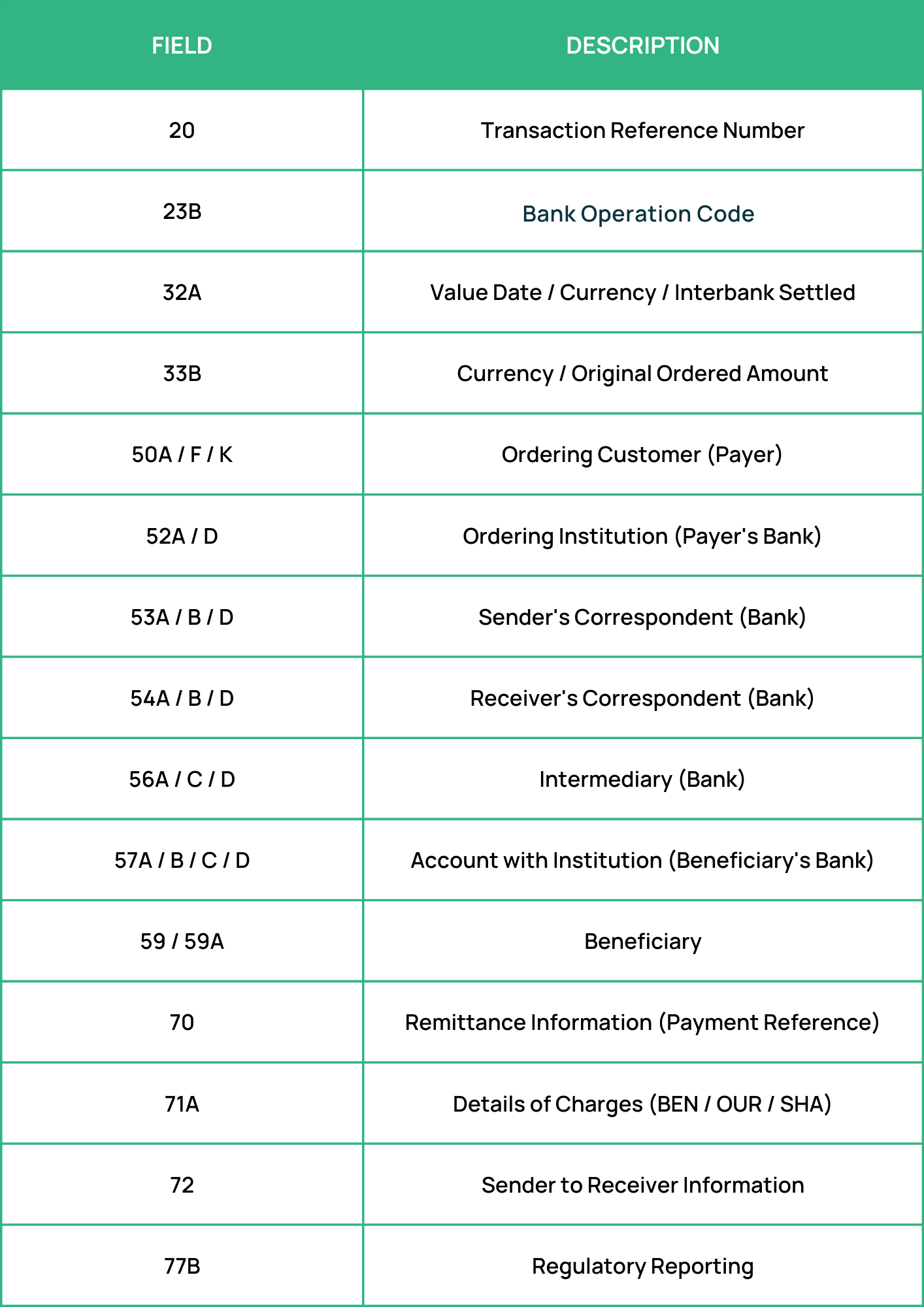

Precisely, the fields in the MT103 document include the following:

In addition, there is also the MT101, which is designed for corporates and bulk payments, and the MT102, built for multi-payment instructions for banks and financial institutions.

What is the purpose of MT103?

Beyond serving as proof of payments for its transactors, the MT103 also helps reinforce the security of the SWIFT Network and provides certainty to global money transfers.

Here is how the SWIFT MT103 document gives you better control of your global transactions:

Confirmation of International Money Transfer

The MT103 document is generated only after the completion of the remittance. In other words, this document also acts as the confirmation of the telegraphic transfer in case there are any disputes such as missing or delayed payments.

This is especially helpful for international businesses that work with foreign vendors, suppliers, or clients for reconciliation purposes. Plus, this document allows both parties to locate the funds if it’s held up in a regional clearing bank or an intermediary bank.

Standardisation

Naturally, making international transactions across multiple currencies and jurisdictions comes with challenges such as language barriers, foreign currency exchange (FX) rates, different regulatory frameworks, and unique standard operating procedures (SOPs).

The SWIFT MT103 document solves this issue by standardising the fields and information, so that it stays the same for all SWIFT members. It is also easy to read and understand, therefore eliminating any misinterpretation of the information.

Payment tracking

In the lengthy process of global payments and routing through multiple intermediaries, there are bound to be scenarios where the funds get held up in regional clearing banks. This may be due to missing information or pending validation.

Regardless, in this case, the MT103 document comes in handy, as it can track the exact location of the fund. Users can then proceed to resolve the issue in the shortest possible time.

How to download your MT103

Here’s a quick breakdown of how to download your SWIFT MT103 document via the Wallex platform:

- Log in to your Wallex account

- Go to Send Money History on the left, where you will see all your payment history

- Identify whether the payment is a SWIFT Transaction or a Local Transfer (the MT103 document is only available for SWIFT payments)

- Select the transaction you want to retrieve the MT103 for by clicking ‘View’

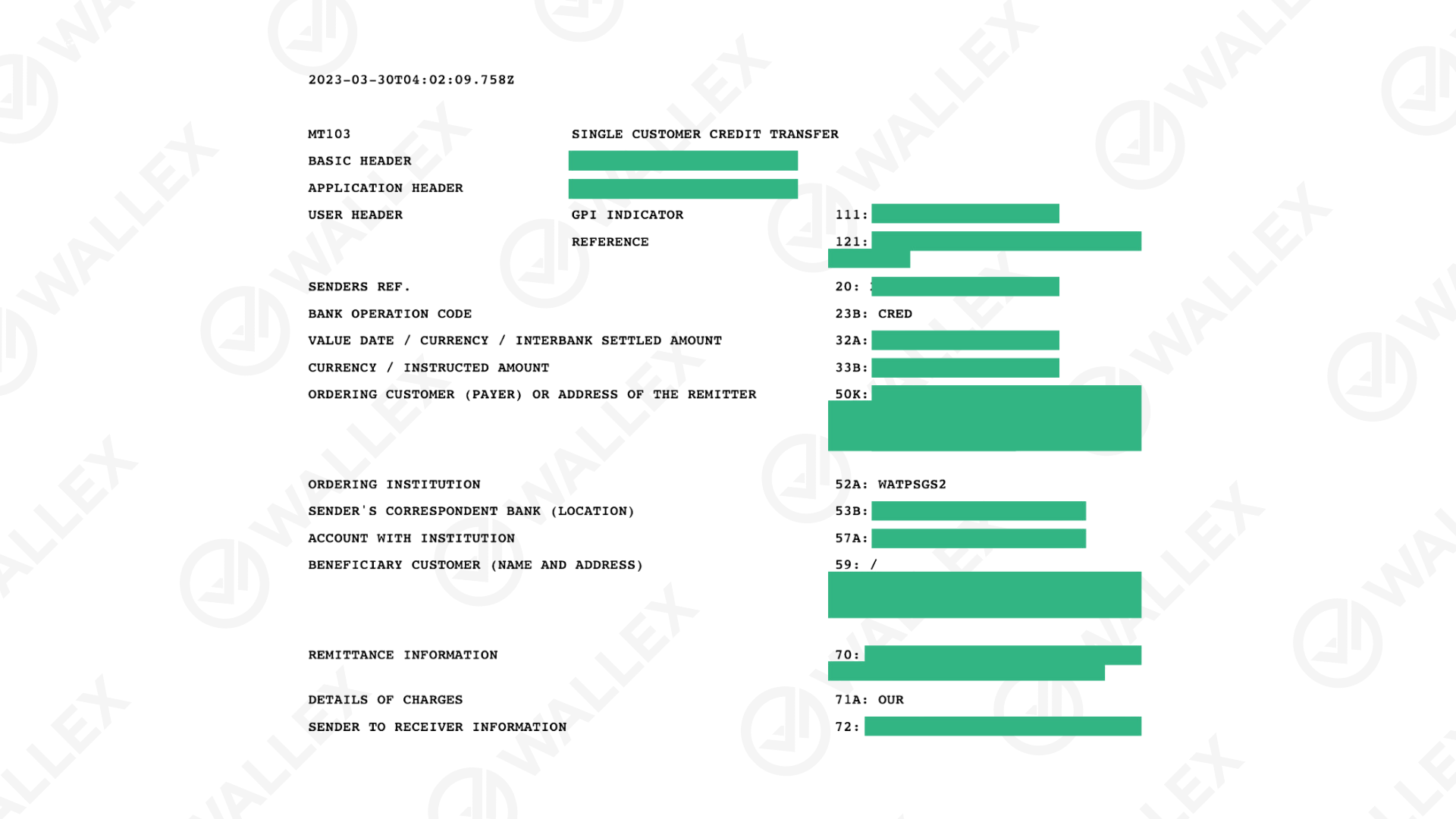

Here’s a sample of the MT103 document on Wallex:

Do I have to pay for MT103?

Here’s the differentiation point. Banks and traditional financial institutions typically don’t produce MT103 documents for users; only upon request. And often, this comes with a fee for the user. The exact process varies from bank to bank. However, it may still take up to days for the banks to pull the paperwork together, which can cause an even longer delay in business operations.

But in FinTech companies like Wallex, the MT103 document will be available as soon as the SWIFT payment is completed, and at $0 cost to the user.

Simplify your cross-border payments with Wallex

Wallex uses an intelligent routing system that deploys SWIFT or Local Transfers depending on a combination of factors like the urgency of the transaction, amount, and currency corridor.

Our Global Business Account enables businesses to hold and convert funds in over 46 currencies. This allows for efficient planning, managing, and hedging of currency volatility from one platform.