Key takeaways:

- Intermediary banks are the middlemen that facilitate transactions between two banks that do not have an official agreement.

- Intermediary banks typically support transactions in one currency whereas correspondent banks support transactions in multiple currencies.

- The fees for intermediary banks can be borne by the beneficiary (BEN), originator (OUR), or shared between both parties (SHA).

What are intermediary banks?

Let’s take travelling for example — ideally, there is always a direct flight to your destination so you don’t have to spend time in transit flights. But the reality is that not all cities have an international airport and you’re often required to make a few stops or connecting flights before reaching your final destination, especially for smaller cities and towns.

Likewise, in an ideal global banking system, every financial institution will be interconnected with each other. In this case, the sender can initiate a transaction at their bank and it would always go directly to the beneficiary’s bank without an intermediary. This would save both time and cost. However, the abundance of financial institutions across the world makes it near-impossible for any organisation to keep track of them.

To solve this, the global banking system relies on intermediaries to facilitate payments when the sender’s bank does not have an established relationship with the beneficiary’s bank.

These intermediaries, middlemen, or third-party banks, are known as intermediary banks, and they help ensure the fund transfer reaches its destination. In exchange, the intermediary banks typically charge a fee for this service.

This type of bank is especially important for global transfers via the SWIFT Network as it bridges two financial institutions under separate jurisdictions. It enables any individual or business to send money from a local bank to a foreign account without the need for the sender’s bank to have a presence in the destination country.

How does an intermediary bank work?

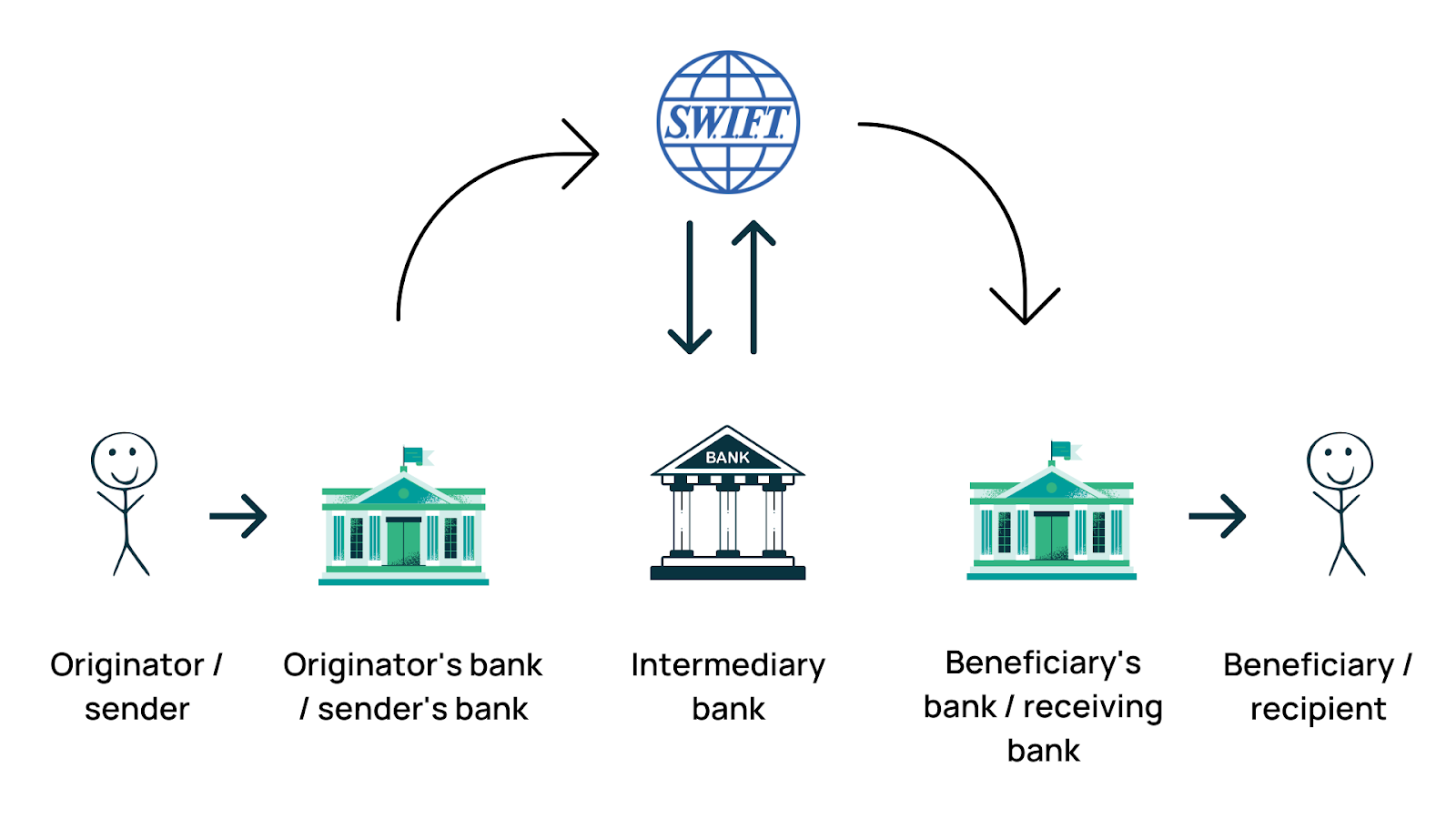

In an international transfer, there are five critical parties involved:

- Originator/sender – An individual or business entity that initiates the translation

- Beneficiary/recipient – An individual or business entity who is designated to receive the funds

- Originator’s bank/sender’s bank – The institution that performs the fund transfer instructions given by the sender to the recipient

- Beneficiary’s bank/receiving bank – The receiving bank or the intended destination of the fund transfer

- Third-party institution(s)/intermediary bank – Any other financial institutions that might be needed to complete the transaction

The function of intermediary banks boils down to three steps: Initiating the transaction → transferring the funds → crediting. To illustrate, here’s an example of the process of an employer paying an overseas employee, with an intermediary bank:

- The employer’s bank (sender’s bank) initiates the transfer.

- If an intermediary bank is needed, these funds will be routed to the intermediary bank in the same country as the employer.

- The intermediary bank transfers the funds to the receiving bank directly.

- The receiving bank credits the employee’s (beneficiary) account with the funds.

In most cases, users don’t have to worry about finding an intermediary bank — instead, this will be done behind the scenes by their financial institution.

The intermediary banks that each financial institution uses can vary. However, these are generally well-established banks with an international presence. For instance, JPMorgan Chase Bank serves as the intermediary for USD transactions, Royal Bank of Scotland for GBP, and PT Bank DBS Indonesia for IDR.

Intermediary banks vs correspondent banks

Intermediary banks often get lumped together with correspondent banks. Depending on the country, intermediary banks can either be distinct from correspondent banks, or they can be used synonymously with the term “correspondent bank”.

For the former, here are the fine lines that separate the roles of an intermediary bank and a correspondent bank:

- Intermediary banks typically support global transfers in one currency only whereas correspondent banks support transactions denominated in multiple currencies. For example, if a business is initiating a transfer from Singapore to Indonesia, a correspondent bank would be responsible for the transactions from SGD to IDR.

- Correspondent banks are required to adhere to stricter regulations and due diligence procedures compared to intermediary banks.

- Intermediary banks may or may not have an existing agreement with the sender’s bank, while correspondent banks have established legal agreements.

What are the fees for intermediary banks?

On average, the intermediary fees at between $15 to $50 USD per transaction or more. However, this will vary depending on the currency and the fixed charges levied. On top of this, there is also a possibility that more than one intermediary bank is required, which will lead to an even higher total fee for users.

These fees can be paid in different ways, depending on the agreement between the sender and the recipient, using the standard SWIFT form — field 71A (Details of Charges). This is then broken down into three options: BEN, OUR, and SHA.

BEN (Beneficiary)

The sender or the originator does not incur any charges. All charges, including the charges of the intermediary and beneficiary bank, will be borne by the beneficiary.

This method also means that the final amount the beneficiary receives will be less than the initial amount sent.

OUR (Originator)

Under this option, the sender (or originator) pays for all of the intermediary fees and sending and receiving bank charges.

However, the caveat is that the originator’s bank will not know the total fee ahead of the completion of the transaction. Therefore, a fixed fee is typically provided to the senders based on the estimated cost of a cross-border transaction, which sits around $60 to $70 USD on average.

Through this option, the sender can ensure the amount received will be exactly the same as the intended amount, which is an important consideration when paying suppliers.

SHA (Shared)

This option is for dividing the costs between the originator and the beneficiary. Generally, the originator will be charged a standard fee from their own bank while the beneficiary pays for the charges on their respective institution, plus any intermediary fees. SHA is the most common type of charge option as it allows each party to bear their respective fees.

Takeaway

Intermediary banks connect the financial system around the world and enable individuals and businesses to make global transactions. Without this middleman, activities such as working with international suppliers, expanding into a foreign market, or even hiring foreign talents, would likely not exist.

However, the dependency on these intermediary banks has allowed these institutions to charge a hefty transaction fee for their services. Despite having the option to choose how the fees will be paid, it often makes a dent in the total transaction amount.

Consider Wallex’s Multi-Currency Wallet, where you can hold and manage up to 14 currencies. This helps you minimise and control your cross-border FX costs while streamlining your global operations.