Doing business abroad comes with the additional hassle of moving money from Indonesia and making international payments to various business partners, suppliers and staff based in other countries.

There are a host of variables to take into account.

What are the options? Which is the cheapest way to send money abroad? Are they reliable and easy to use? Do they accommodate business transactions? Are there any limitations to using alternatives like Banks when making overseas payments? Do they offer additional services?

We have answered all these questions and some more in this article.

Let's say you have to pay a USD 25,000 invoice to your supplier RJ Manufacturing in the United States of America. Now let’s address each of these questions

Alternatives for overseas payments from Indonesia

Unlike western countries, the choices from Indonesia to make payments are actually limited.

Banks : Traditionally most businesses have relied on the services of big banks where they may have their bank accounts. Leading banks continue to offer currency conversions and overseas transfers. For this FX comparison we have used rates published by a leading local bank, referred to as Bank B.

International remittance providers : Companies like Wise (erstwhile Transferwise) now offer some of their services in Indonesia as well and are gaining traction in the market. We refer it as company W in this comparison.

Fintech Alternatives : Fintech alternatives are very few in Indonesia as most are actually licensed to receive money in Indonesia , but not to make payments from Indonesia to other foreign Currencies. Wallex is a leading non-bank alternative that is in fact licensed by Bank Indonesia to enable its customers to send funds overseas from Indonesia. For this comparison to be fair, we have also considered another local fintech company (referred as Company T).

So now let us compare the services between Wallex, Local Bank B, International Remittance Company W and Local Remittance Company T.

#1 Ability to serve businesses

Unlike personal accounts, a business account can be registered under a company name rather than your own, which helps protect your privacy. While setting up a business account might take a couple of more steps for verification compared to personal accounts, this also means it offers more benefits.

As a specialist B2B payment company, Wallex is designed for business and is able to support customers to make frequent international transactions (e.g. over 100 transactions in one go) , higher value of transactions as well as better security governance for your company.

Wallex provides a robust suite of products and services designed specifically to help businesses carrying out overseas financial transactions. There are no caps on the transaction amount, enabling our customers to make payments as high as USD 100,000 (~IDR 1,445.625,000) in a single transaction from Indonesia.

Company W’s offering in Indonesia is restricted to Individuals ( a person sending money to a self / family / friend abroad ) and not for business purposes ( i.e. a business making payments to business partners, staff and suppliers ). For this reason, it does not qualify to compare what it would cost a business to send a large sum of $25000 in a single transaction through their platform.

Local Company T, like it’s international counterpart Company W, was designed with individual customers in mind. While they offer their services to businesses now, they struggle with handling scale of transactions or the features needed to support businesses.

Local Bank B serves it’s individual and businesses customers for making FX payments. However, the process is physical and involves going to the nearest branch to make an overseas payment.

Summary : Wallex, Company T & Local Bank B can support payments for businesses but Company W can not.

#2 Cost-effectiveness

The two main fees when it comes to international payments are service/upfront fees and exchange rates markup.

1. Fees

Banks often say they have low, or even no fees, but they might hide extra fees in a marked-up rate to cover those costs.This extortionate transfer fees are exactly the reason why you want to avoid using banks and perhaps why you are looking for other alternatives, especially if you do a frequent payments.

International remittance company W typically offers its fees as a % of the value of the transaction e.g. 1.2% of the value. This can prove to be very expensive especially as the value of your transaction increases.

In the comparison below, we check our prices against local bank B and a local remittance provider T.

In Indonesia, Wallex is currently offering a flat fee of 100,000 IDR for every transaction, no tiering. So irrespective of the payment being a $25000 payment or a $250000 payment , the fee remains constant. This shows you how much you could save by switching to a fintech alternative like Wallex .

Note: Don’t get fooled by the lower FX fees offered by Company T. In fact fees should always be viewed in conjunction with the exchange rate offered to understand the total cost of making this payment. So let us get into that now.

2. Exchange rate

We all see the exchange rate on Google, but we all also know we never actually get that rate. It is a commonly accepted fact that banks or remittance providers will add a markup or premium to that price.

We compared the exchange rate for our transaction on 7th April 2021 (at the same time to ensure fairness and transparency)

Local Company T offered the worst foreign exchange rate amongst all options. So while they offer low fees they make up for it by padding their exchange rate. Bank B has the second highest rate for the transaction. Our customer in fact got the best rate for sending USD from Indonesia on Wallex.

Wallex provides bank-beating exchange rates to its customers thanks to its network of payment partners. Rates are also locked in for 24 hours till you fund your payment to provide you a further layer of contingency and protection in case the rate moves further up.

As you can see in the comparison above, some other remittance provider might offer you cheaper or even zero fees. But they have actually included those fees in their markup exchange rate. So, at the end of the day, you still pay a lot for your cross-border payment.

*published rates on 7 April 2021 at 12.57 WIB.

Summary: At the end of the day, if you combine the costs incurred through FX fees and Mark Up on Exchange rate , you still pay a lot for your cross-border payment.

Wallex is the most cost effective option considering the combination of FX rates and FX Fees. Our customer here needed the least amount of IDR to complete a USD 25,000 payment through Wallex - up to 2,411,250 IDR cheaper than other alternatives for overseas transfers from Indonesia.

Conclusion on Comparing Costs

Based on these cost calculations - if a similar payment was made just once a month - it would result in annual savings for over 25 mils IDR!

Bonus Comparisons:

At the beginning of the article we promised to deliver additional parameters than just the cost of making the transfer so you can make a fully educated decision on which alternative is best for you.

#3 Time to deliver the funds

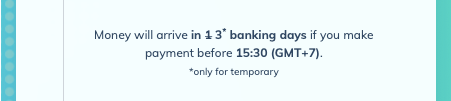

For businesses, speed is as important as cost-effectiveness - and also highly dependent on the currencies you choose. A standard timeline for most international bank transfers is about 2 to 4 business days, while for some other local remittance providers in Indonesia, funds will be delivered in the next business days.

Wallex uses an intelligent routing system that deploys SWIFT or Local transfers depending on a combination of factors like urgency of transaction, amount, currency corridor amongst many others. Wallex delivers super fast payments in 47 currencies from Indonesia.

Marugame Udon Indonesia was previously battling with the slow transaction process while using banks for overseas payments. After switching to Wallex, they managed to achieve higher efficiency by saving 1-2 business days on every international transaction.

Summary: Wallex was the fastest option to make a USD payment from Indonesia for this payment.

#4 Ease of Transacting and making payments

As a business user, most finance managers and owners end up making multiple transactions at the same time. E.g. making payroll payments. To do this via bank B means you have to physically go to the bank and create individual payments.

We offer a range of services to streamline your business payment including bulk payment and bulk approval features, also multi-level approver matrix that are designed around convenience, so your company doesn’t spend tons of administration time on making or receiving payments. You can setup the account in a few minutes, and get started with sending and receiving funds moments after that. You’ll get regular updates on the progress of your transfer and you can manage everything through a single online platform. Even better, Wallex is the most cost-effective compared to other services available in Indonesia. Let’s dive into this.

#5 Range of currencies support

In this example, the payment was made in USD - which is the most common traded currency. What if you have to make payments to another supplier, let’s say to Saudi Arabia in SAR, which is not supported by most banks or local remittance companies?

Most banks usually support payment in 10-16 currencies. Bank B supports payments in 16 currencies while Local Company T supports payments in 24 currencies. However, both of them don’t support payment in SAR.

With Wallex, you can send payments in 47 currencies including a range of ‘exotic’ currencies that are not available in most other remittance providers such as EGP, KWD, DKK. We are constantly widening our currency offerings, do talk to us for any specific requests.

Summary: Wallex covers the widest range of currencies including ‘exotic’ currencies like SAR which is not supported by other providers.

#6 : Support

Making international payments might be confusing and you don't want to make mistakes especially when you're sending money under your company's behalf.

Bank B would provide a relationship manager for the business account on a case to case basis and that comes with its own pre-requisites on maintaining account balance and a certain size of business.

The local remittance company T did not provide any in person contact.

The International remittance company W is a very low touch business module and support is mainly provided only through messages on their app through

Wallex provided a dedicated account manager to it’s business customers. These account managers are available on phone or whatsapp locally to support customers needs and queries - in Bahasa Indonesia!

Summary: There is no other digital remittance provider that provides a dedicated account manager so Wallex is clearly the winner in this case.

Recap of advantages of choosing Wallex for making international payments :

- Pay for large sums which are not supported by other players like Wise (previously TransferWise) or even some local fintechs - which operate only in an individual capacity.

- Flat fees work better with larger amounts as the fee does not increase if the payment is 25,000 IDR or 100,000 IDR - unlike with other international players.

- Ability to pay directly to suppliers in exotic currencies which includes currencies like SAR, DKK, KWD etc. which are not offered by other remittance providers including Banks. You would need to route funds via a country like Singapore which would result in double the FX costs you would have to incur.

- Easily make multiple bank payments to employees, suppliers, customers and partners in one go. Wallex's bulk payment feature allows you to set up, review and fund multiple payments in different currencies in a single transaction - automating your processes and making them more efficient.

- Have better governance and control by having multiple levels of approval review to process your multiple transactions. This will help you streamline purchasing—cutting out tedious manual routing, data collection and reporting.

Talk to our FX expert to get a personalized FX calculation and see how much you can save up.

*Terms & condition apply