Sending money to someone else halfway across the world has never been easier and global trade and commerce has been all the better for it. But it wasn't always this way. In fact, moving money across borders digitally is a relatively new phenomenon, aided by the payments infrastructure and technologies that emerged in recent times.

To put things in perspective, SWIFT was only established in 1973. When you consider that humans have been trading with each other for millennia, SWIFT sounds like it was only introduced yesterday!

Technology will continue to advance and so will international payment solutions. To understand the trajectory that it will take in future, it helps to have an idea of the history of international payments and how we got to where we are today.

Key Takeaways:

- The history of international payments spans millenia, evolving from barter trade to gold coins.

- Promissory notes, bills of exchange and bank notes emerged later as a way to avoid transporting large amounts of coins for trading and transactions.

- Modern systems and technologies such as the SWIFT and ACH networks, and cryptocurrencies have changed the face of international payments.

From bartering to coins (~6,000 B.C - 100 B.C)

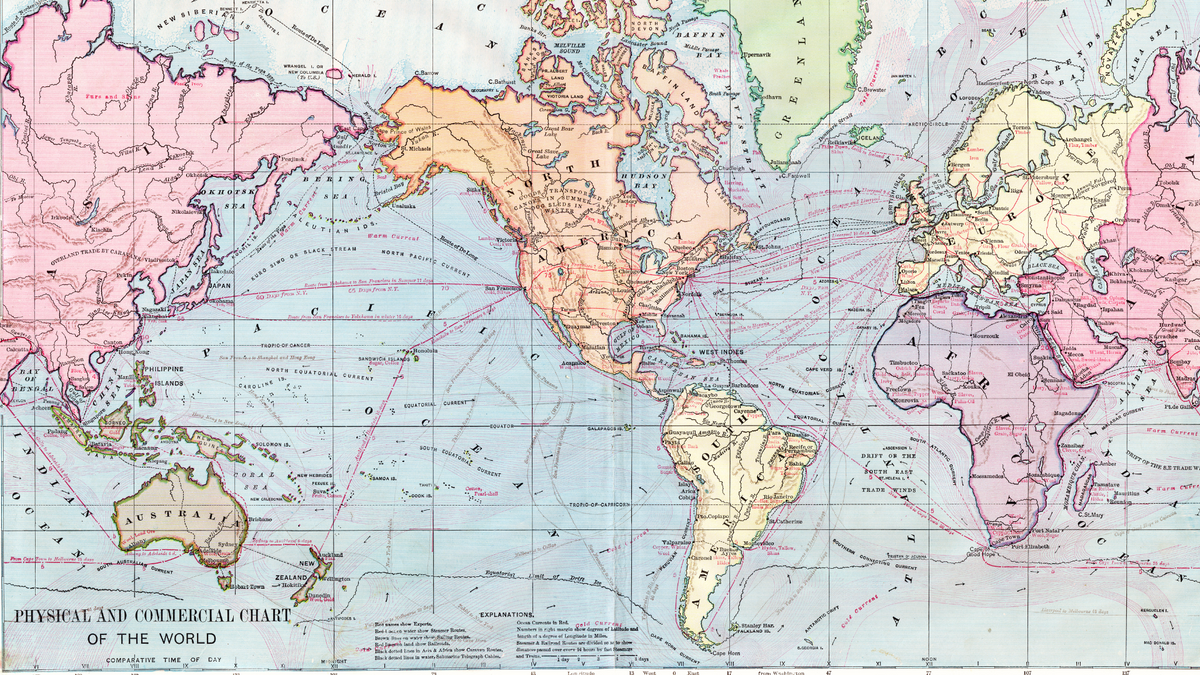

Trade was the driving force behind the early development of international payments, as merchants sought to conduct transactions across vast distances, and bartering was the first established system of payment, where goods or services are exchanged directly for other goods or services. The earliest records of such transactions date back to around the sixth millennium B.C in Mesopotamia.

Bartering could be thought of as the first form of FX or international payments.

However, it was not a straightforward process. If a merchant, for example, sought to buy a pair of shoes, he would need to exchange something that his seller would consider to be of equal value, which could mean anything from three jugs of milk to a bushel of wheat.

Over time, this ambiguity over value would slowly fade away as items such as livestock, grain and weapons became the medium of exchange, bringing more predictability into trade.

Around 650 B.C, the first coins were minted by the Lydians, who were also the first to mint gold coins. By the first century B.C, gold and silver coins were being used across the Roman Empire.

Towards bank notes and telegraphic transfers (~100 BC - 1872)

Promissory, and eventually bank notes emerged when payments in coins began to become too physically demanding to transport around for transactions. Promissory notes were first seen around 118 BC in China's Han dynasty, an early form of a debt instrument in which the issuer made a promise in writing to pay the holder a pre-determined amount of money by a particular date.

Later, during the medieval and Renaissance period in Europe, widespread use of bills of exchange began. These were a form of promissory note, with the main difference being that they were used more specifically for international trade, rather than domestic.

Bills of exchange are documents specifying that the purchasing entity agrees to make payment to the seller a set amount of money at a pre-determined time for goods delivered. In such cases, the bill of exchange is issued by a third-party entity like a bank, due to the risks of international transactions.

A buyer who failed to fulfill their terms of the agreement could have their debt acquired by the bank, who, after paying the seller's bank, could then pursue the buyer for repayment. In this way, bills of exchange acted as early forms of international payment and credit instruments.

Using bills of exchange enabled merchants to overcome barriers posed by the use of different currencies and the need for physical movement of money.

The 1840s saw the invention of the telegraph, which paved the way for the first wire transfer service by Western Union in 1872. Senders would pay their money to a telegraph office and provide instructions on who it should be sent to. Operators would then, by use of passwords and codes, "wire" the funds to another office, for release to the authorised recipient.

The rise of SWIFT and ACH networks (1960s - 1970s)

Wire transfers would become the primary form of money transfer and international payments until the establishment of the ACH (Automated Clearing House) and SWIFT (Society for Worldwide Interbank Financial Telecommunication) networks.

First established in the United States in the 1960s, the ACH network processes financial transactions for a wide range of entities, including businesses, consumers, and governmental bodies, by facilitating seamless transfers of funds between different bank accounts.

When an ACH transaction is initiated, it is submitted to an originating financial institution. From there, the transaction data enters the network, where it is sorted, grouped, and processed in batches. These batches are then transmitted to receiving financial institutions, which subsequently credit or debit the appropriate accounts. To date, the ACH network has processed over 30 billion transactions and over $73 trillion USD.

Later, in 1973 the SWIFT messaging network was launched with the support of 239 banks in 15 countries.

The SWIFT network allows financial institutions to securely exchange information and instructions related to cross-border transactions. It provides a standardised and secure platform for transmitting various types of messages, including payment instructions, trade documentation, and other financial messages.

SWIFT messages are used for international transfers, especially for high-value or complex transactions that involve multiple banks and countries. SWIFT codes (also known as BIC codes) are used to uniquely identify financial institutions in the network.

The rise of the SWIFT and ACH networks were turning points in the history of international payments. They paved the way for its modernisation, reduced friction in the settlement of financial transactions, and enhanced the connectivity of global economies.

Blockchain, cryptocurrencies and beyond (2000s - present)

By the late 20th century, the internet and rapid digital transformation has led to drove the development of payment technologies and infrastructure that simplified how people sent money. The advent of blockchain technology introduced a decentralised and transparent ledger system that formed the basis of cryptocurrencies, which allows for direct peer-to-peer transactions via digital wallets, bypassing traditional intermediaries and payment networks.

These are gaining momentum in adoption as more businesses become crypto-friendly, accepting payments in digital currencies such as cryptocurrency. Many have begun accepting Bitcoin and Ethereum for goods and services. For them, crypocurrencies are a way to bridge currency gaps, reduce reliance on intermediaries, and reach a wider audience.

So, what will the future of international payments look like?

While no one can say for sure the exact direction that payment networks will develop in, the things that central banks are doing now provide a hint. As of 2023, a total of 130 countries are trialing the use of central bank digital currencies (CBDCs) which are issued and managed by central banks.

Many consider digital currencies to be an eventual replacement to physical cash as more people and businesses shift towards mobile and digital payments and CBDCs look primed to lead the way in adoption of digital currencies. However, it is important to note that we are still in uncharted territory on this front, as the regulation and governance of such currencies continue to be discussed.

Simplify the complexity of international payments with Wallex

One recurring theme in the history of international payments is that it is constantly bringing people and businesses closer together by bridging time and distance.

This is the core of what we do at Wallex, Asia's leading FX and payments solutions provider. Supporting your business is our business, and we're here to bring you greater speed, support and savings in how you conduct your international payments.

Our platform enables you to seamlessly pay in 48 currencies to over 160 countries, collect in 36 currencies, convert FX at competitive, near mid-market rates, and hold 13 top global and Asian currencies. Above all, you'll get double the value at half the cost, with better speed, support and savings that banks and other remittance providers can't match.

Talk to us today to find out what Wallex can do for your business!