Background

Almaflor is a vinyl importer based in Surabaya, Indonesia and has 13 official distributors across Indonesia. Almaflor products are manufactured or sourced in China. The company makes regular high value payments 2 - 4 times every month.

Almaflor previously relied on their corporate banking relationship with Indonesia's leading bank BCA to make USD payment from Indonesia to their suppliers and manufacturers in China.

The Challenge

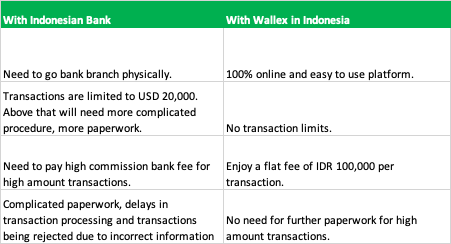

When assessing their payments solutions using BCA Corporate Banking, Almaflor saw several areas that needed to be improved, specifically the need to be more cost and time-efficient given the frequent payments they were making each month.

#Costs

The amount of transaction using BCA Corporate Banking was largely limited to USD 25,000. Transactions of value more than USD 25,000 require more complicated paperwork. This required Almaflor executives to split their invoice payments and higher cost incurred on transaction fees.

Not only that, because the bank charged a % fee, the higher the payment value, the higher the cost.

#Delays and Rejections

With the complicated nature of paperwork, there would be delays in processing the payment and delays in funds being received by Almaflor's vendors. Rejection on payments was increasing and resulted in the need to execute the payment all over again.

#Strain on resources

Splitting invoice payments to manage the USD25,000 restriction resulted in more time invested plus difficulties in reconciliation at the recipients' end.

Without a dedicated finance team and the owners managing all payments themselves, Almaflor definitely required a more efficient and convenient solution for their international payment needs.

Solution

When owner and decision maker Ms. Ruth Nathania was introduced to Wallex, she was immediately drawn to the fact that there was no limit to the overseas payment amount she could send for supplier payments to China. This eliminated all the struggles that she had to go through with her previous choice of payment provider.

Wallex made a compelling case for Almaflor to switch their payment provider with their flat fee offering in Indonesia instead of a % fee, saving her thousands of dollars in FX fees.

The easy-to-use and secure online platform completely eliminated the need for multiple visits to the branch and saved her lots of time by being able to set up and execute transactions from anywhere at all.

Realising that Wallex is already trusted by 20000+ customers in Asia and is also regulated in Indonesia, Ruth decided to give it a try.

Within a few weeks of signing up with Wallex, Almaflor has made over 10 payments in USD to their suppliers and manufacturers in China ranging from USD50,000 - USD 250,000 - all online without any transaction limits.

Result

Now, by using the Wallex's online platform and simpler payment experience, the team is saving hours of time every week.

- Almaflor benefit from Wallex's flat fee for international payment versus the Bank's % fee on every transaction

- Avails of competitive rates compared to Banks and other payment alternatives in Indonesia

- Streamline processes and reduce workload to make large payments of ranging from USD50,000 - USD 250,000 from Indonesia to China in a more simplified and efficient manner

- Improved payment reconciliation for suppliers & manufacturers.

Globalise your business and simplify your payments with Wallex. Get in touch with our FX expert and learn how we can help you save time and money while you scale your business.