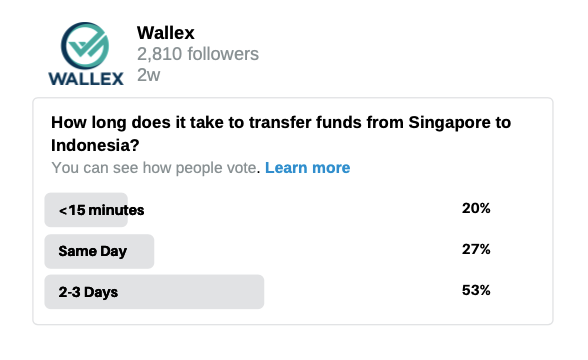

We recently ran a poll with a simple question:

How long does it take to transfer funds from Singapore to Indonesia?

Before you see the answer , we ask you. How long does it take to send money to Indonesia from Singapore. Your options are

- <15 mins

- Same Day

- 2-3 Days

If you answered 2-3 days or same day, you are with the majority.

80% of those surveyed assumed it takes a day or more to send money to Indonesia. If you think so too, you will be surprised. With Wallex it’s possible to send funds from Singapore to Indonesia in less than 15 minutes* if you're sending to BCA account.

Keep reading to know more.

How long does a wire transfer take

Interbank wire transfers (also known as SWIFT transfers) have been around for years. Businesses all over the world rely on them to pay vendors, consultants and freelancers, and to receive funds from clients and customers. Wire transfers are reliable, and one of the safest ways to make or receive business funds.

However, their costs more than outweigh these benefits, which many businesses are unaware of.

For one, international bank transfers are expensive. It’s quite common for banks to take a margin of over 5%, and charge an additional transaction fee on each foreign payment. Next, banks deliberately make their international payments landscape opaque, so many business users end up paying hidden charges and fees that are not revealed until it’s too late. The international exchange rate, locked in at the time of the transfer, is rarely in the sender’s favour, and usually constitutes the biggest hidden cost of such transfers. Moreover, banks often use the time “required” to move money, to float the sender’s money and gain as much interest as they can. Wire transfers can also be expensive for receivers, since they also have to pay a fee or charge to receive their money.

In addition to the financial burden, another cost of international wire transfers is transfer speeds. Payments in major currencies take anywhere from 2-5 business days, depending on the sending and receiving countries and banks, transfer amounts, etc. If transfers are initiated on or just before a weekend or public holiday, they can take even longer. More exotic currencies can also take longer than 5 days. Businesses that need same-day transfers end up paying an additional fee as a quick send premium (similar to same-day shipping costs), which adds to their final costs.

Transfer speeds with International Money Transfers (IMT)

Many businesses go to an IMT specialist to manage their overseas transfers. These providers usually offer more competitive exchange rates, and lower transfer fees than banks. Nonetheless, they can still be expensive due to exchange rate fluctuations, fees, and even third-party fees, all of which can add up very quickly for large-value or frequent transactions. Some providers also have limits on how much a company can send over 24 hours, a week or a month, which restricts their ability to participate fully in international business.

Transfer speeds are also an issue with IMT providers. Businesses should be aware that a cross-border transaction can take anywhere from 1-3 business days, so if they need fast transfers, this is also not the best option.

Then what is?

Fast Transfers from Indonesia and Singapore to the World with Wallex

With a Wallex Business Account, businesses in Indonesia and Singapore can take full advantage of low fees, competitive exchange rates and of course, faster transfer speeds.

*BCA beneficiaries only

**For up to 500k SGD or equivalent. T&C applies

With this account, business users can seamlessly manage their payments, receivables and cashflows, which is a huge advantage in a post-COVID world that’s full of business challenges, customer demands, and falling revenues.

The platform offers competitive exchange rates for 47 foreign currencies, compared to just 10-16 currencies offered by most banks. Indonesian businesses can enjoy almost real-time transfers to other BCA accounts, which almost no other FinTech platform can promise. Right from funding the payment to executing transactions with a particular exchange rate – everything is done online and completely transparent. No unnecessary delays and no hidden fees, only fast transfers, affordable rates and full convenience.

Here’s what Mr Akmad from Marugame Udon Indonesia said about his Wallex experience:

“After using Wallex, we are able to reduce 50% to 60% of our international transfer costs. This is a good example of a finance platform that helps businesses run more efficiently.”

Another happy customer, Investree, a Jakarta-based B2B financial technology lending company, also achieved huge savings in terms of both time and money with Wallex. By switching from banks to Wallex for their international funds transfers, Investree saved up to 70% in fees, and 1-2 business days on every cross-border transaction. Considering that this fast-growing company makes 5 to 10 international transactions every month, these are huge advantages in a highly competitive industry.

Sign up for Wallex Business Account (it’s free!)

Today’s businesses have many opportunities to expand operations beyond their home borders, and reach a wider customer base. However, slow international funds transfers can be a big obstacle to such ambitions.

You don’t have to continue with slow, opaque and expensive bank transfers, when a much faster, cheaper and simpler option is available! Sign up for a Wallex Business Account for free or talk to our FX expert to get rate calculation. For more information, visit Wallex.