The rapid evolution of technology has profoundly altered the banking and financial services industries across the world. With the rise of brash new fintech startups, many traditional banks are starting to feel the heat. In less than a decade, fintech startups have metamorphosed into multi-billion-dollar enterprises with hundreds of millions of customers.

While individual consumers relish improved access to financial products and allied services, small and medium-sized enterprises (SMEs) have lagged behind. In the ASEAN market, where they form the backbone of most national economies, this is far from ideal.

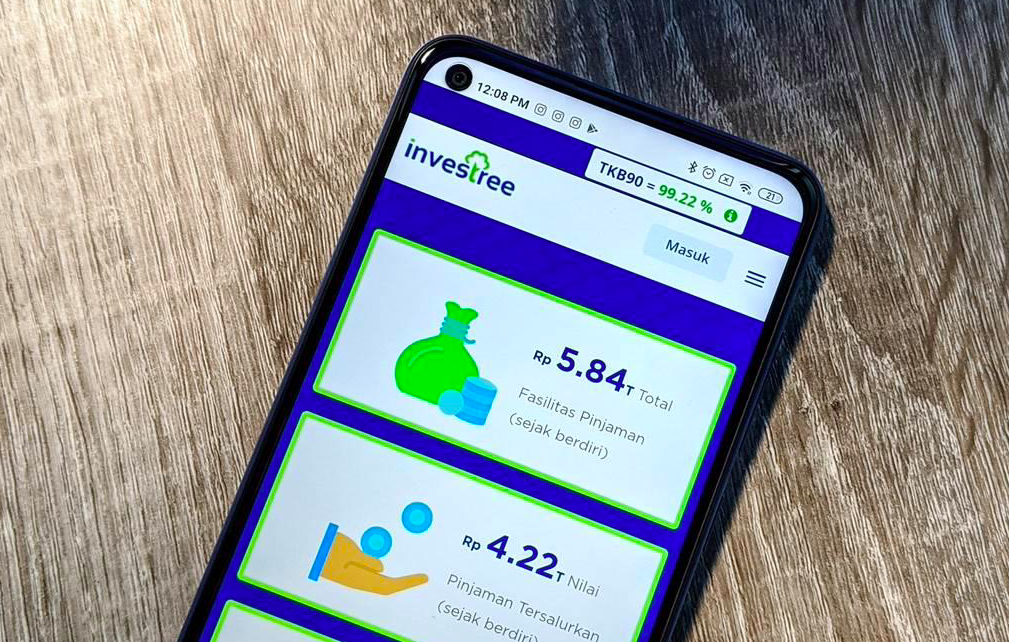

Investree is a B2B financial technology lending company in Asia with a mission to use data and technology to make financing more accessible and affordable to SMEs, while also connecting them with lenders who want to support them and gain an attractive return.

Through collaborations with strategic partners in the digital and financial ecosystem as well as the creation of innovative financing products, Investree commits to continuously provide various digital solutions for SMEs.

Investree sought better operational efficiency and productivity amidst regional expansion

While expanding into Thailand and the Philippines, Investree realised they would need a single, integrated platform to manage finances, optimise productivity, and maintain growth momentum.

Relying on banks for their cross-border transfers to Southeast Asia, the US and Europe had several limitations in in terms of speed, simplicity and efficiency.

Eventually, they decided to switch to Wallex.

"As we expanded out of the country, we needed fast solutions for cross-border payments. While our banks are great, there are limitations for cross-border transactions. That was what necessitated the switch to Wallex," - Liliana Bambang, CFO, Investree

Choosing Wallex empowers Investree with better speed, support, savings and simplicity

Investree saw the benefits of switching almost immediately, saving up to 70% in fees on their cross-border payments.

With their Wallex Business account. Investree now enjoys more competitive FX fees and can ensure the timely delivery of funds.

It has helped the finance team become more efficient, allowing them to perform overseas transfers around-the-clock, from funding the payment to executing the transaction with a pre-locked in exchange rate. Everything can be done online seamlessly, and the best part for them is their dedicated account manager from Wallex, who is always ready assist with any transaction process.

Why Investree Switched to Wallex

1. Speed

Investree saves up to 2 business days on every cross-border payment, which is critical for the 5 to 10 transactions they make each month — particularly for their interest payments.

2. Support

Investree enjoys quick responses and support from their dedicated account managers based locally for any query, big or small.

3. Savings

Wallex provides personalised fees and near mid-market exchange rates which Investree can lock in for 24 hours, ensuring they can secure a favourable exchange rate.

4. Simplicity

Investree can configure and make payments anywhere and anytime, with Wallex's secure and easy-to-use conline platform.

Experience smart and low-cost payment solutions for your business with Wallex

Wallex is more than just money transfers for your borderless business. We exist to give you the best financial solution at every stage of your growing business.

Wallex has provided currency exchange and global payment needs to several successful companies in Asia, and we can do the same for your business. There is no question that our fast, simple, and dedicated support is a major factor in Investree's success today.

For more information about Wallex and learn how it can help make your business run more efficiently and practically, please visit www.wallex.asia or talk to our FX expert to learn how Wallex can benefit your business.