International bank transfers (also known as SWIFT transfers or credit transfers) are a popular method for B2B cross-border payments. Although reliable and safe, such transfers are insanely expensive. There are many fees, and worse, hidden costs involved, all of which add up over time, and can seriously affect your company’s bottomline and cash flow.

In this brief article, we outline these fees and charges that you end up paying with interbank transfers. Many of these charges are not obvious, because the banks won’t tell you about them! So before you waste any more of your hard-earned money, take a look at the list below.

1. Transfer fees

Every money transfer organisation will charge you a service fee for transferring funds internationally. This may be a flat fee, a tiered fee or a % of the amount that you wish to transfer. Banks charge as much as 3-5%, sometimes even more. Naturally, the higher the transfer amount, the higher the fees. Some banks will charge a different rate depending upon the currency in which your money is sent, so you might pay a higher fee if you send the money in a currency that is different from your recipient’s local currency e.g. sending AUD to a recipient in the US. If you want your money transfer expedited, you might incur yet another additional fee.

Banks execute wire transfers under the currency exchange rate they set, which is always higher than the actual (market) exchange rate. Moreover, they usually use a tiered fee system, so that this exchange rate margin depends on the transfer amount. This “markup” fee is usually the least transparent (hidden) part of your total transfer cost. To know more, see #3 below.

And finally, for same-day transfers, many banks also charge a “quick send premium”, that’s similar to same-day shipping costs. It can be as high as 10% that you will incur over the original transfer amount.

2. Intermediary bank fees

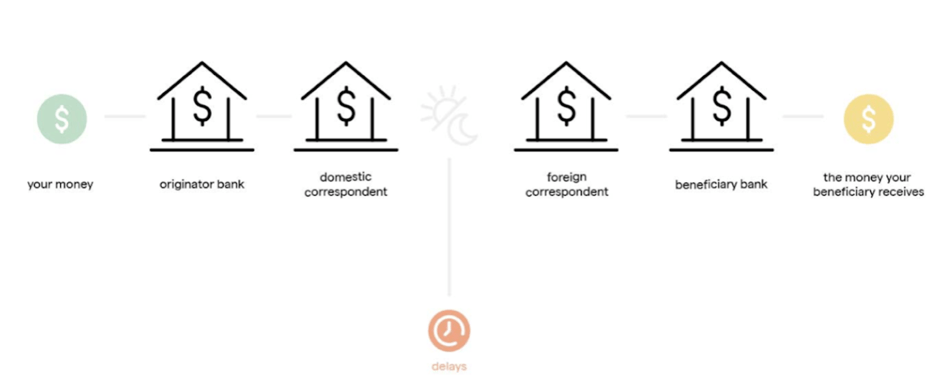

In interbank transfers, it’s not just the sending bank that slaps a fee on every international transaction. Intermediate banks also add their own charges to the transfer amount.

Every international wire transfer passes through one or more intermediate banks (typically 1-3) on the way to the recipient’s bank. When the banks in the sender’s and recipient’s countries do not have a direct financial relationship, and therefore cannot transfer money to each other directly, the intermediary bank(s) helps complete the transaction. In return, they collect a flat fee or “cut” known as the intermediary/beneficiary bank charge. This typically ranges from $10 - $20 (USD). It can also go up to $30 (USD). It rarely goes below $10.

What about alternative money transfer methods? Most offer flat fees that are much lower than interbank transfer fees. For example, Wallex, an international money transfer service, offers a customized fee based on their customers’ needs. The fees are tailored based on the size of business, amount and frequency of transaction. Wallex is licensed and regulated in Singapore, Indonesia and Hong Kong. So, it’s a perfect solution for growing businesses in these regions.

3. Markup on currency exchange

Simply put, the currency exchange rate is the rate at which one currency may be converted into another. It is usually shown in a currency pair such as USD/SGD which indicates a conversion from USD to SGD, along with a price to indicate the exchange rate. When you send money internationally, you have to choose the source and destination currencies to see the exchange rate.

Many businesses don’t realise that the exchange rate they incur for interbank transactions is not the same as the “true” exchange rate. This latter, also called the market rate, inter-bank rate, or mid-market rate is like a wholesale rate that’s only available to large financial institutions like banks that typically purchase large volumes of currency. This is also the rate that banks pay when exchanging money, or when trading with each other.

But when you transfer funds internationally, the bank will offer a different rate and charge fees on the currency exchange. This rate difference is known as the spread or exchange rate markup. A high proportion of your cost is embedded within this markup – which is not visible. For smaller amounts, the exchange rate margin is a lot higher, so if you transfer smaller amounts frequently, you will end up paying a lot more than you expected.

This rate is typically around 0.7% to 1.5% at most major banks, so if you’re sending $10,000, you may have to pay up to $150.

It is interesting to observe that certain remittance service providers who claim to provide the ‘real exchange rate’ or the ‘mid-market rate’ add in the currency mark up to their transfer fee or service fee. So, while you may have competitive rates, you may end up with significant transfer fees.

Here’s how to spot a hidden cost on your exchange rate:

SGD/IDR mid-market exchange rate = 10,702.71

(It takes 10,702.71 IDR to buy 1 SGD)

Transfer amount = 1000 SGD

Amount expected to reach recipient = 10,702,710 IDR

However,

Bank SGD/IDR currency exchange rate = 10,500

Amount actually received by recipient = 10,500,000 IDR

Difference (expected – actual) = 202,710 IDR

The difference of 202,710 IDR is the exchange rate markup. If you don’t know the mid-market exchange rate, this difference ends up being a hidden fee. Moreover, you won’t even know how much you’re incurring until the transaction is already complete. Banks frequently take advantage of this lack of knowledge to further decrease transparency.

Unlike banks, Wallex provides competitive exchange rates that are as close to mid-market rates as possible. So if you want to convert your foreign exchange, you can do so at a near mid-market rate in 47 currencies. You can also collect your funds in a global receiving account in multiple currencies with no charges, or make low-cost payments in 180+ countries and 40+ currencies with access to the fairest FX rates and transparent fees. Avoid banks’ unfavourable rates and fees, save on multiple conversion fees, and reduce FX losses to increase your net earnings. Get started with Wallex here.

4. Incoming fees for recipients

During interbank transfers, destination banks also charge a fee to deposit the incoming money in the recipient’s account. This ranges from $10 - $20, but can also go up to $15 - $25. This reduces the amount the recipient ultimately receives and affects your relationship with them.

With Wallex, you can choose whether you want to split these fees between you and your recipients, to ensure a fair transfer that doesn’t overly burden any one party.

In Summary

| Regular Business Bank account | Multi currency business bank account | Wallex Account for Business | |

| What you get | You receive a single account number. Any payment in foreign currency (e.g. USD) is automatically converted to local currency (e.g. SGD). |

You receive a single account number supporting selected currencies. Balances are maintained by segregated currencies in single account. |

You get personalised account numbers in multiple countries. Balances accumulated in these accounts reflect under the Wallex Wallet balance, segregated by currencies. |

| Minimum Balance requirement | Yes | Yes | No |

| Supports Foreign currencies | No | Typically support 8 to 13 currencies |

46 currencies to make payments Convert into 46 currencies Collect in 35 currencies from international marketplaces 13 currencies to hold balance |

| Fees on international payments | % charge | % charge | Customised to your needs |

| FX Conversion on currency conversions | Expensive FX margin decided by Bank | Expensive FX margin decided by Bank + Fee | Transparent, bank-beating FX margins |

| Charges to you on incoming wire transfer | Yes | Yes |

No |

| Charges to your customer for making payment to foreign bank | Yes | Yes | No |

| Speed of international transfer | Not Applicable | 2-4 working days | Same-day payments |

How to Waive or Reduce International Transfer Fees

On a large international bank transfer, say $50,000, you could end up incurring $1,000 in these fees and charges. Since banks rarely provide a “frequent flyer discount”, every time you make a cross-border payment, you will incur these fees.

Wallex provides cheaper, faster and more convenient ways to send and receive funds internationally. Our forex conversions, local receiving account, international payments and multi-currency wallet are all customised and low-cost offerings that are perfect for growing SMBs. We provide near mid-market rates that are locked for 24 hours to protect you from exchange rate fluctuations. This means you can leverage the best possible exchange rate, and make transfers at the best possible time!

Unlike banks and their tiered fees and hidden charges, Wallex offers full transparency from start to end. Our clients have saved 50-60% on their international transfer fees, and so can you. Moreover, the more you transact with us, the more you will save. Our FX experts will calculate the fees and rates customised for your business. Find out more: www.wallex.asia