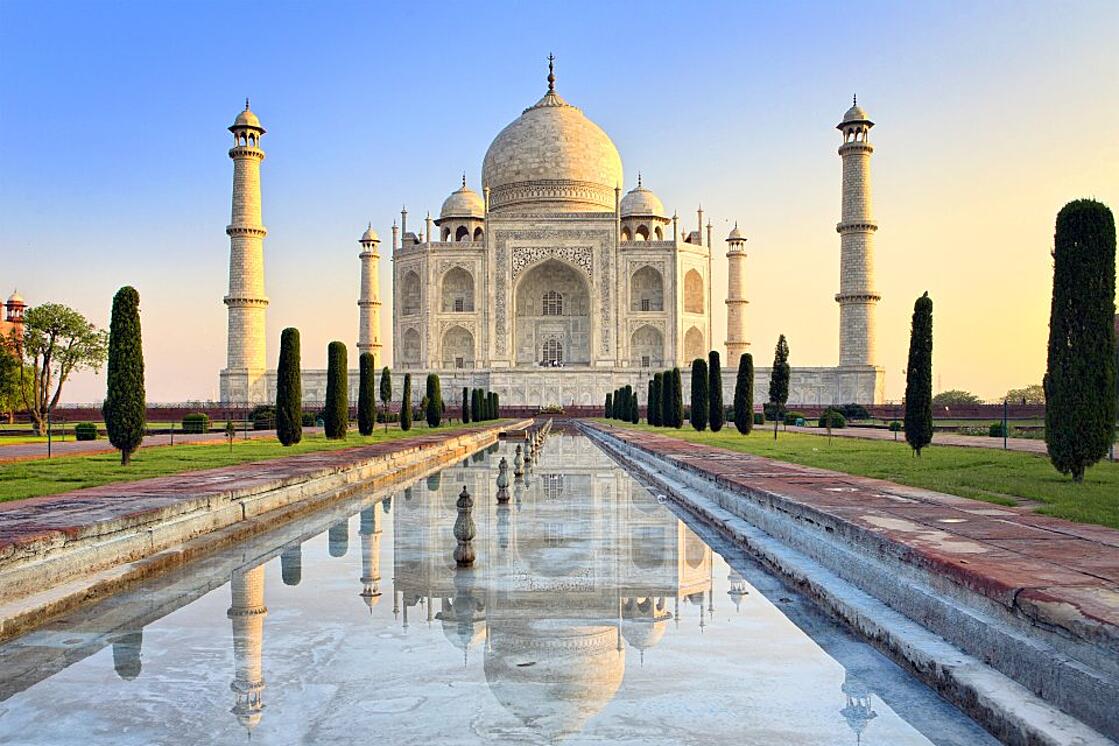

What’s a country with trading ties to almost all nations across the globe, yet has an enormous pool of world-class talents? India.

As this nation develops and infrastructures continue to push past prior limitations, businesses are increasingly looking to India to set up an office. However, one thing that still remains cumbersome is the underlying financial system that facilitates cross-border transactions.

In this article, we aim to break all the components of an international transaction to and from India, using its local currency, the Indian Rupee.

Key takeaways

- The Indian rupee is the official currency of India, governed by the Reserve Bank of India (RBI) on the basis of the Reserve Bank of India Act, 1934.

- The Indian Financial System Code (IFSC) is an 11-digit code assigned by the RBI to every bank branch in the country to identify the recipient bank and branch.

- A typical global payment to India takes anywhere from a few seconds to a day.

Understanding the Indian Rupee

The Indian rupee is the official currency of India. This currency is subdivided into 100 paise, though as of 2019, coins with the denomination of 50 paise or lower are no longer recognised as legal tender. As for its governance, the Reserve Bank of India (RBI) manages the currency on the basis of the Reserve Bank of India Act, 1934.

Challenges of the Rupee

Largely due to the fact that India is still a developing country with limited technology, the Indian Rupee is constrained by certain challenges. Here’s a breakdown of them:

Conversion restrictions

At the time of writing, the Indian rupee is a partially convertible currency, and only about 45% of the currency is freely convertible for international transactions. The remainder of the currency is controlled by the Reserve Bank of India (RBI) through a system of capital controls. In other words, this capital control limits the amount of INR that enters or leaves the nation.

Consequently, this makes it rather arduous for businesses that must make international business payments but does not have a direct partner (or an intermediary) to facilitate the cross-border transaction.

However, there has been some progress made towards looser currency control.

Low liquidity

Owing to being a partially convertible currency, the INR is among the most thinly traded currencies in the FX market. Ergo, it is heavily subjected to macroeconomic factors such as political stability and monetary policies, which may cause heightened volatility during periods of uncertainty.

Not just that, the strict capital controls imposed on the currency also hampered the currency’s trading volume as it cannot be used in international transactions (with a few exceptions). As a result, most trades in INR are conducted within India, but not with international businesses, leading many to label the currency as an exotic currency.

As a result of the low demand, the INR is one of the weakest currencies in Asia and is subjected to large devaluations against major currencies such as the US dollar and the Japanese yen. This has led to concerns about its long-term viability and has made it difficult for Indian exports to compete in the global markets.

However, despite these challenges, the Indian rupee remains a crucial currency in Asia as the country holds one of the world’s largest pools of labourers, and this is likely to continue playing a significant role in the region’s economy in the years ahead.

What is the Indian Financial System Code (IFSC)?

The Indian Financial System Code (IFSC) is an essential component when it comes to sending money to and from India for businesses. This is an 11-digit code assigned by the RBI to every bank branch in the country to better facilitate cross-border transactions.

The IFSC code is used to identify the recipient banks and branches, thereby reducing the errors and delays during the transfer process and ensuring that the payment is routed correctly. This allows businesses to send money quickly and securely to their Indian partners or subsidiaries.

How to make business payments from SGD to INR

Here’s a list of what you need to make an international payment from SGD to INR:

- Account holder name – The name in your bank records

- Account number – The 6-20 characters that identify the unique beneficiary bank account. Often referred to as an International Bank Account Number (IBAN)

- SWIFT Code – SWIFT code consists of 9 or 11 characters used to identify a specific bank in an international transaction.

- IFSC Code – An 11-character alphanumeric code that identifies individual bank branches for electronic fund transfers in India. *Note: Certain locations in India may require additional information. Please contact us here if you need any further clarifications.

- Purpose payment code – Payment purpose codes, as the name implies, allow payees to include information on the purpose of the payment. The necessity of this depends on the jurisdiction(s) of which the transaction is made.

Setting up a payment in INR

Follow the steps below to send payments to India through Wallex:

Step 1: Open a Wallex account

Sign up for an account with Wallex here. Our sign-up process costs $0 and takes only a few minutes.

Step 2: Add your beneficiaries

Once you’ve completed our account verification process, you can add your beneficiaries and set up your international payment.

Step 3: Start transacting

Click on the intended beneficiary, fill in the details of the payment, and hit send.

Step 4: Track payments

On Wallex, you will have complete transparency over your payment at each stage of the process with the SWIFT MT103 document.

How long does it take to send money to India?

The speed of transaction settlement varies depending on the payment method you choose (SWIFT transfer or local transfer) and the payment service provider.

However, with Wallex, our wide range of payment partners around the world enables us to skip the middlemen to get faster processing times. Typically, a global payment to India takes anywhere from a few seconds to a day.

How much does it cost to send money to India?

Sending money in INR requires a small service fee and the applicable FX rates. You can check the indicative rate below before initiating the payment.

How Wallex can help with your global payments

At Wallex, you’ll have access to mid-market rates and a transparent fee structure, so you’ll never be caught with any hidden fees. Not just that, you’ll also have access to over 46 currencies across 180 countries. Learn more about Wallex and how we can help take your business to the next level here.