While it has yet to happen on a significant level, there are murmurs of de-dollarisation among nations who want to reduce their reliance on the US dollar. If such a movement were to gain momentum it could have significant implications for the global economic situation.

In this article, we will take a look at what some of these implications may be, how it affects other currencies, the way nations and businesses transact, and more.

Key Takeaways:

- De-dollarisation is the process of a country reducing its reliance on the USD in international transactions

- Such strategies may be motivated by concerns over the United States’ fiscal policies, economic performance, and geopolitical hostilities

- De-dollarisation could trigger market instability and shift the dynamics of cross-border trade

Understanding de-dollarisation

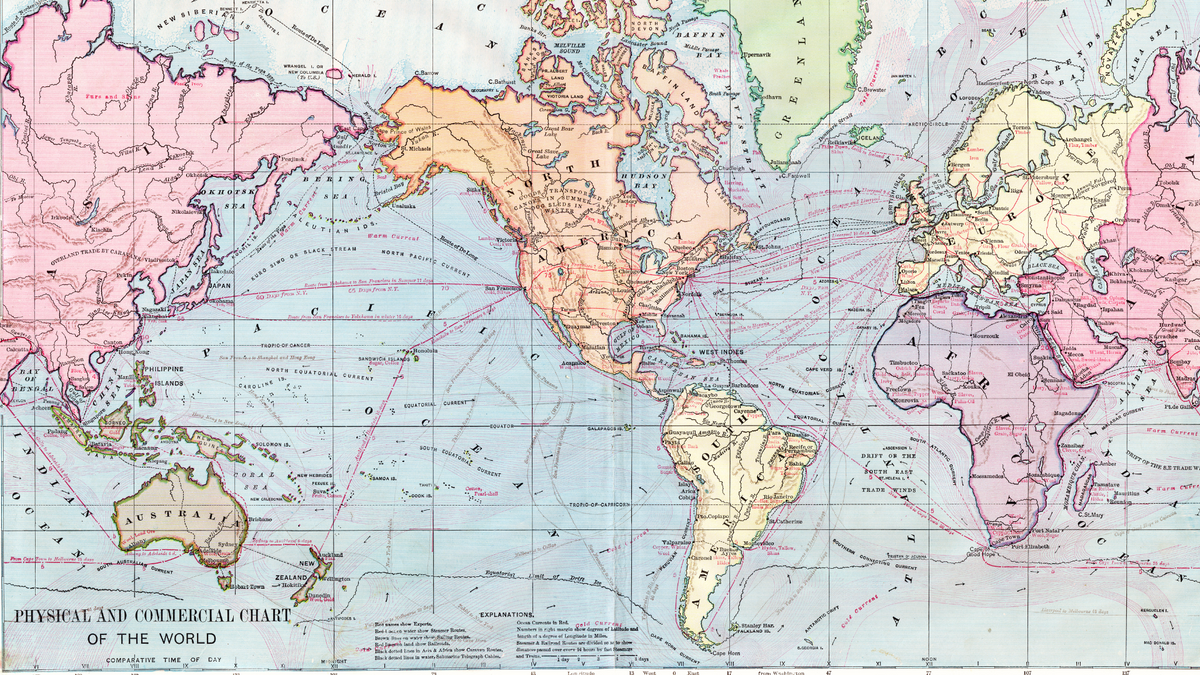

De-dollarisation refers to the process in which countries reduce their dependence on the US dollar and diversify their currency reserves. This movement has already gained some traction in recent years, with several countries taking steps to shift away from the USD in their economic dealings.

However, the US dollar has been the world’s reserve currency for over 70 years. Why would a country want to take the potentially risky decision to move away what is traditionally considered to the a safe haven?

Let's look at some key reasons.

1. Fears over stability

As it stands, the USD is the dominant currency in the world, and was used in nearly 80% of global trade between 1999 and 2019. This gives the US a huge amount of power when it comes to setting interest rates, trade policies and other economic factors. But this, alongside concerns over inflation and the United States' budget deficit, may create large fluctuations in its value, which can be concerning for countries who hold significant amounts of USD.

2. Geopolitical tensionand hostilities

Among other tensions, the United States and its partners such as the EU are often at loggerheads with countries such as China, Iran and Russia, which typically result in trade sanctions being levied. Countries on the receiving end of these sanctions would have reduced access global markets, causing economic disruption.

3. Rising economic competition

Being the second largest economy in the world has made the Chinese yuan one of the biggest threats to the USD, and the country is also actively leading heading efforts to accelerate the movement, particularly alongside its peers in the BRICS (Brazil, Russia, India, China South Africa) nations, who account for 26% of the global economy. Increasingly, more countries such as Saudi Arabia, Iran, and Indonesia are also looking to join the bloc.

4. Cryptocurrencies

Another factor catalysing de-dollarisation is the emergence of cryptocurrencies, which many feel may potentially be an alternative to fiat. Some, like Bitcoin, are fully decentralised and insulated from interference by institutions like central banks, making them an attractive alternative. Already, countries like Venezuela have fully embraced Bitcoin in their bid to de-dollarise, and Honduras has set up a special economic zone where Bitcoin is accepted as legal tender.

Potential impacts of de-dollarisation on the global economy

No one can say for certain what can happen in a world where the USD is not the de facto currency because there are many variables to consider, such as the extent of de-dollarisation, and which currencies emerge to take its place, if any.

In the hypothethical event that the US dollar is ever dethroned, there is little doubt that global financial markets will be thrust into turmoil, with the scenarios below being potential outcomes.

Reshape hierarchy between currencies

De-dollarisation could fundamentally alter the balance of power among different currencies in the global financial system. Should nations ever actively distance themselves from the USD, currencies from some of the largest economies or blocs could gain greater prominence in international transactions, particularly those of major economies such as the euro, yen, and yuan.

- Euro: The euro could become the primary currency for trade within the European Union and could also gain greater acceptance for international transactions.

- Yen: The yen may benefit from Japan's position as a major creditor nation and its role as a hub for financial markets in Asia.

- Yuan: The yuan could become a more widely used currency for international transactions, particularly in Asia, as China seeks to strengthen its economic and financial influence.

Currently, the USD, the euro, the yen, the pound sterling, and the Swiss franc are the primary reserve currencies, with the USD making up nearly 60% of total global foreign exchange reserves. If the de-dollarisation movement ever gains pace, other currencies may take its spot. For instance, China's yuan has become increasingly popular in international payments and could emerge as a viable substitute.

The transition to alternative reserve currencies could lead to changes in the structure of the international monetary system. Multilateral efforts might arise to create mechanisms for stabilising and coordinating different reserve currencies. These efforts could involve the International Monetary Fund (IMF) and other international organisations coming together to ensure the stability and liquidity of the global financial system in the absence of a single dominant currency.

Introduce market volatility and instability

Exchange rate fluctuations between the USD and other currencies could trigger significant movements in currency markets, impacting international trade competitiveness, cross-border investments, and even triggering speculative trading. Such exchange rate volatility can create uncertainty for businesses and investors, affecting their risk management strategies and decision-making processes.

Capital flows would almost certainly be affected as investors reassess their portfolios in response to changing currency dynamics.

Financial institutions and governments are likely to respond by developing new risk management frameworks. Hedging mechanisms such as currency swaps, options, and forward contracts, might become more prominent, and new financial instruments may even emerge.

Shift dynamics of cross-border trade

Almost immediately, there would be newfound complexities over the way nations approach existing trade agreements and frameworks. Without a standard underlying currency, they would have to renegotiate, redraw, or even reconsider these contracts, which could hurt employment, agricultural output, manufacturing and more on both sides of the equation.

Businesses might also have to prepare themselves for higher transaction costs because now, they would need to convert currencies more often and navigate more complex payment systems. The use of multiple currencies and settlement systems could also make international transactions more complex and less efficient.

Complications are likely to arise in the commodities market where oil, gold, grain, and others are usually quoted in USD. The shift to another currency may make trading difficult, with other consequences that range from trade imbalances to supply chain shortages and even food security concerns.

One bright spot that de-dollarisation shines on trade is that it could potentially open up new markets and opportunities for countries that have never been heavily reliant on the USD. Gaining new access to diverse currency markets could promote economic growth and diversification for these countries and pave the way for stronger financial inclusion worldwide.

Accelerate adoption of cryptocurrencies

In a world where the dollar is no longer king, there is a possibility that digital currencies will play an important role in international transactions. One of the primary advantages of cryptocurrencies like Bitcoin is its decentralised nature, making it less susceptible to government or central bank interference.

Bitcoin has already emerged as a potential alternative to traditional fiat currencies in international transactions. In recent years, many cryptocurrency exchanges have begun offering services to facilitate cross-border payments, allowing users to send and receive funds in various digital currencies, making it a viable option for those seeking to reduce their reliance on traditional banking systems and fiat currencies.

Moreover, cryptocurrencies may also provide a solution to the challenges posed by fluctuating exchange rates and the costs associated with currency conversion. As digital currencies become more widely accepted, they could help to streamline international transactions and reduce overhead costs for businesses.

Drive up debt that has been issued in dollars

Nations and companies that have issued dollar-denominated debt might face challenges as the value of their domestic currency may depreciate relative to the dollar, drastically increasing the cost of servicing the debt.

For emerging market economies, the risk and costs involved will be more severe as a further weakening of their currency against the USD could lead to budgetary pressures, economic instability, and potential sovereign default risks.

Investors are likely to reassess their appetite for dollar-denominated debt from countries undergoing de-dollarisation as well. Faced with higher currency risk, investors will demand higher yields as compensation, making it more expensive for these countries to access international capital markets. This could limit their ability to raise funds for development and investment projects.

Could de-dollarisation really happen?

One thing to note is that the scenarios listed above are just possibilities, which means it is unlikely to happen in the near future. While there have been efforts by countries like China and Russia to promote the use of their own currencies, the USD still accounts for the majority of cross-border payments.

The pace of de-dollarisation efforts is also uncertain, with some countries and regions moving faster than others. The success of these efforts will depend on a variety of factors, including political stability, economic growth, and technological advancements.

While there may be growing interest in diversifying currency reserves, concerns about the viability and readiness of alternative currencies persist. The complexities and uncertainties surrounding alternative currencies, combined with the intricate web of global financial relationships, indicate that a complete de-dollarisation in the near future is highly improbable.

Hedge against currency volatility with Wallex

Fluctuations in currency values are a given, and the best way to hedge your risk is to diversify your currency holdings. Wallex lets you do just that with its Multi-Currency Account, allowing you to hold 13 top global and Asian currencies including the GBP, EUR, SGD, CHF, and JPY.

The Multi-Currency Account also makes it possible for you to hold currencies for as long as you want, so you can easily manage your currencies and time your conversions to when rates are favourable.

Wallex, however, does more than help you hedge against currency volatility. Our platform takes away the complexities and costs that businesses face when moving money across borders. Payments are faster and easier with Local transfers, collections can be made in 36 different currencies, and you can enjoy round-the-clock support from a dedicated Account Manager should you encounter any issue.

Learn more about Wallex here or get in touch today!