Today, plenty of modern businesses are looking to expand their operations beyond borders. On this exciting internationalisation journey, international payments naturally play a critical role – helping them expand into new markets, increase conversions and even enhance lifetime customer value. But for a lot of organisations – especially SMEs that are starting to internationalise – cross-border payments can be a complex minefield of confusing jargon and puzzling rules.

In this article, we demystify this jargon so you can understand the international payments landscape better, and make the most of it to grow your business.

Foreign currency transaction and currency exchange

For a firm in one country doing business with a firm in another country, international payments usually involve foreign currency transactions, which require currency exchange (foreign exchange). Simply put, foreign exchange (forex or FX) is the trading of one currency for another. For example, suppose a Singaporean company needs to buy materials from a supplier in Germany. The supplier only accepts payments in Euros, so the business in Singapore changes its SGD into Euros to pay the supplier. The same Singapore-based company also buys equipment from a Chinese supplier who accepts payments only in their local currency, the yuan. However, since the yuan is not as freely convertible as the Euro, the two parties use USD as a ‘reserve currency’. So the company in Singapore exchanges SGD into USD, and the Chinese vendor then accesses these funds in USD. Both cases involve foreign currency transactions and currency exchanges.

The market determines the relative values of currencies against each other by means of exchange rates. So the SGD/Euro exchange rate would not be the same as the exchange rates between SGD/USD or the rate between SGD/Yuan.

Cross-border Transfer

When money is transferred from one party to another across international borders – regardless of the payment method – it constitutes an international payment or cross-border transfer.

The modern payments system has evolved over the years to include a number of methods for making (and receiving) international payments. This system now involves diverse elements including the international banking system, clearing facilities, transacting parties and the payment (i.e. funds) itself.

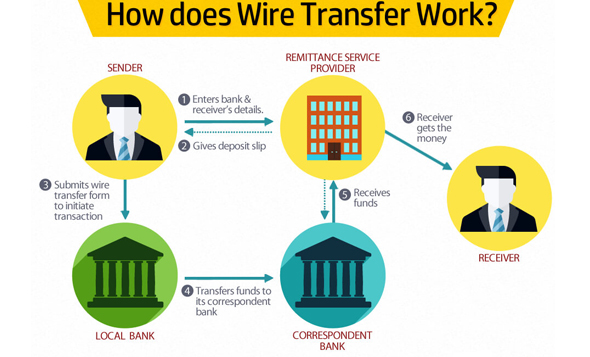

Remittance Service Provider or Money transmitter

A Remittance service provider or a money transmitter is a type of money service business (MSB) that permits the rapid and secure transfer of funds between businesses in different countries. Usually, they offer a cheaper and faster alternative to banks. The service provider collects currency from its customers in the sending country, sends transfer instructions to its affiliate in the receiving country, deposits the currency into a bank account, and effects one or more electronic funds transfers through the bank to settle its accounts with the affiliates.

Wire transfers and SWIFT

Traditionally, businesses relied on international bank transfers for cross-border payments. Major banks in each country are linked to and communicate with each other over SWIFT (Society for Worldwide Interbank Financial Telecommunication), an electronic communication network, and secure global payment and settlement system.

With an international payment, the funds transfer is initiated by a paying party or ‘originator’. This party instructs their bank to carry out payment to the account of a ‘beneficiary’ with the beneficiary's bank. Before the advent of SWIFT, these messages were usually transmitted by cable, telex or wire, which led to the terms ‘wire transfer’ and ‘wire payment.’

A wire transfer payment is executed by the originator's bank debiting the originator's account, and by the beneficiary's bank crediting the beneficiary's account. The international wire payment is then executed through a SWIFT message from the former to the latter. If the receiving bank is not the bank of the beneficiary, it acts as an ‘intermediary’. It sends another message over that country’s national wire system to the beneficiary's bank and settles with it on the books of the central bank. When this settlement is complete, the beneficiary receives their payment.

International wire transfers typically involve high bank fees and lifting fees from intermediary banks, in addition to ‘currency conversion’ fees – all of which affect the final payment amount received by the beneficiary. Over time, these costs can really add up to a non-optimal payment method for cross-border businesses.

Payment Processor

Payment processors are key links in the overseas transfers payment processing chain and facilitated the transaction.

A payment processor executes a payment transaction by transmitting data between the buyer and seller, as well their respective banks.

IBAN

An International Bank Account Number (IBAN) , is a standard numbering system developed to identify overseas bank accounts. An IBAN does not ‘replace’ a bank's own account number. It simply provides additional information that helps in identifying overseas payments.

The IBAN is NOT the same as a SWIFT code. Although both play an essential role in the smooth running of the international financial market, a SWIFT code identifies a specific bank during an international transaction, whereas IBAN is identifies an individual account.

Virtual IBAN

For companies with an international presence, currency accounts based on virtual IBANs are an efficient way to streamline collections, payments, FX conversions and cash flows. A virtual IBAN enables companies to maintain a cost-efficient structure of multiple currency account numbers, one account number per currency or per client. Then, payments in different currencies are channelled through these virtual IBANs and either deposited in their original currency into a physical account or converted into a functional currency.

A specific virtual IBAN for each client or currency enables firms to identify where each incoming payment comes from, which simplifies reconciliation. For payments, virtual IBANs simplify payments management in different currencies, improves transaction efficiency and provides greater control over cash flows/liquidity. Finally, by opting for collection in local currency, firms can avoid hefty FX conversion fees, which reduces their costs.

Local currency account

A local currency account is an account that a seller in one country can open in a customer’s country to hold funds in the customer’s currency. With it, a customer can make a payment in their local currency without having to convert it into the seller’s currency. The seller can then hold this payment in the account if the currency conversion rate is not in their favour. If it is in their favour, they can transfer the money to their local bank account. In other words, a local currency account enables them to ‘hedge’ against currency fluctuations and eliminates the need for constant back-and-forth foreign exchange conversions.

Wallex provides easy-to-use local currency accounts that enable businesses to receive payments in their customers’ local currency. These payments clear faster than interbank payments. Plus, with this account, they get greater control over disbursements, they can avoid unfavourable exchange rates and choose when to ‘Wallet’ their funds.

Multi-currency account

With a multi-currency account, sometimes called a foreign currency account or borderless account, businesses can hold multiple currencies, similar to what they could do with a digital wallet. They can also easily convert the supported currencies, and send or receive foreign currencies. This flexibility is ideal for firms who send or receive money from abroad on a regular basis. A multi-currency account reduces the risk of losses due to exchange rate fluctuations. It also offers ‘rate spread’ due to the timing differences between incoming and outgoing (multi)currency flows.

Designed to simplify FX based accounts receivables , the multi-currency wallet from Wallex enables businesses to easily hold, convert and pay using multiple currencies while managing their FX risk. The wallet also connects your balances directly to other cross-border tools for international payments, FX conversions and global collections so they can handle their funds easily, efficiently and safely.

Wrap up

We hope this guide helps you clear your pressing doubts about international payments. Wallex offers a number of low-cost, simple, secure and fast cross-border solutions to help you manage your international business from one easy platform. International payments, transactional FX, collections and more – take your business global with full confidence, with Wallex.